Mobile App Market Overview

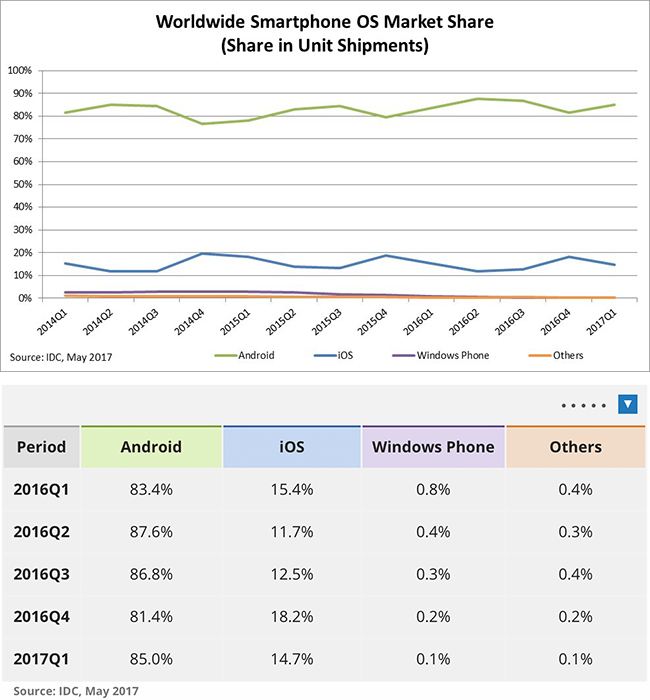

Android The discussion around Android’s share of the smartphone market became irrelevant a few years back when it became clear that devices running Google’s OS would continue to capture roughly 85% of the worldwide smartphone volume. What is interesting is to look at the many micro-trends going on within the platform. Despite a slew of very attractive high-end Android products, IDC continues to see Android average selling prices (ASPs) decline and expectations are that the 1.5 billion Android phones that ship in 2021 will have a collective ASP of $198, down from $220 in 2017Q1.

iOS Coming off the first year in which iPhone shipments declined, expectations are that 2017 volumes will grow 3.8%. IDC slightly lowered its 2017 projections for iOS in its latest forecast to 223.6 million, while increasing its 2018 volumes to 240.4 million. All signs point to late 2017 and certainly, 2018 being very strong for Apple as much of its installed base seems ready for a refresh and the next round of iPhones is not likely to disappoint its fans.

Windows Phone Windows Phone shipments continue to fall as the lack of new hardware partners, developer support, and overall enthusiasm for the platform show no immediate signs of recovery. IDC expects 2017 volumes to decline 80.9% to just 1.1 million units. Microsoft has yet to fully commit to any “Surface”-style attack for smartphones or to push new vendors to embrace the platform, leaving little hope of mounting a full scaled comeback in the years to come.

Visit http://www.idc.com/prodserv/smartphone-os-market-share.jsp to learn more.

The time to tap this exciting new product for your credit union members is now!

Contact us via our website or call (800) 537-9035 to arrange a no obligation online demo and discuss our preferred pricing.